New Year, New You, New Home from Florida Peninsula Insurance Company

It’s a new year, and with the unique events of 2020 we are all looking forward to a brighter new year filled with health, happiness, and hope…and very possibly, a new home.

You have been saving for years to buy your first home, or to move to our state. Our geographic position as a peninsula allows us to enjoy the ocean breezes and the warm tropical air from both coasts. The Florida lifestyle is a paradise sought-after by many, but there is a price to pay for paradise. Homeowners policy premiums in Florida can be double what they are in other parts of the nation. Here is what to look for to save money on your insurance premiums when you are looking to purchase a new home:

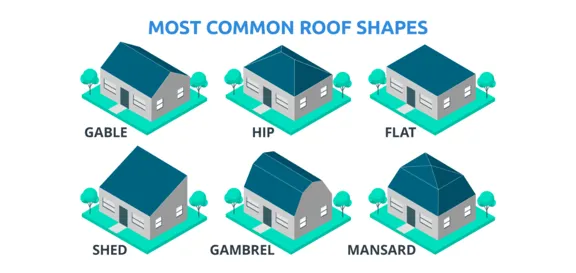

Roofs: Yes, the shape of a roof matters. Some are more resistant to the Florida tropical weather, as such, homeowner insurance companies tend to favor roofs which can withstand the force of hurricane winds.

The most common types of roofs in Florida, are Hip, Gable, or flat roofs.

- Hip roofs tend to withstand the force of the winds better, as they have slanted edges to allow the winds to pass over the home.

- Gable roofs have a pointed edge on the side of the home allowing for wind resistance on the side walls of the home.

- Flat roofs tend to puddle, increasing the chances of roof leaks and damage to the interior of the home.

Age of roofs are important as well. They do not last forever; they have an expected life span. Once the expiration of the roof is reached, it should be replaced, as the deterioration or wear and tear from the wind, rain, and salt water can cause damage. A good rule of thumb to determine the life expectancy of a roof is, 15 years for a shingle roof and 20-25 years for tile roofs. When looking at homes, take a look at the roof, if you notice any patchwork or cracked tiles, this may be an indication of a hidden hazard. Talk to your real estate agent or visit the county’s property appraiser site, as oftentimes you are able to see when the roof was replaced.

Having a Hip shaped tile roof installed in the last 5 years will give you the most credits on your homeowners policy.

Hurricane Shutters: Not all shutters are created equal. A home may have existing hurricane protection however, they may not meet the necessary guidelines to allow you to receive credits. Here is what to look for:

- Do the current shutters meet the most recent building codes? – old shutters may do the job, but they will not give you credits on your premium.

- Are all openings protected? – To receive credit, all openings must have up to code protection, including, all windows, doors (including garage door), and skylights. Partial credit will not be given for hurricane protection on only a portion of the openings. It is all or nothing here.

There are many different types of opening protection you can install, ask your county building department what the latest code is for your area. Or your insurance agent can guide you through the process as well.

Pools: What is life in Florida without a pool! Homes with pools can cost your more money. Here is how:

- Pools add value to the home and as such, higher coverage amounts will be required.

- If the pool has a screen enclosure, ensure the policy you seek has enough protection to cover this added structure. Florida Peninsula Insurance Company includes up to $10K coverage for screen enclosures and can be increased up to $50K should your needs require.

Talk to your agent about the location of the pool to ensure the proper coverage is obtained. If the pool’s deck is attached to the home, coverage will be extended under Coverage A of your policy. If the pool is removed from the home it will only be covered under Coverage B, additional structures. Make sure the coverage you need is allocated correctly.

Flood insurance: One of the most common coverages to be neglected by Florida homeowners. Typically, a flood policy costs an average of $400 per year, however, year after year insurers/carriers across the country deny claims because the homeowner did not purchase this important coverage.

- What is flood? Flood is simply defined as rising water. When water from the ground rises this is a flood. If this type of water enters your home and causes damage, you must have a flood policy to cover these damages.

- Why doesn’t my homeowners insurance cover flood damage after a hurricane? A homeowners insurance policy covers damage due to the covered peril of Wind; it does not cover damage due to the peril of flood. As such, many hurricane claims are denied because the damage is caused by the water rising from nearby lakes, canals or storms surge, entering the home and causing damage to the structure and the contents. If however, the wind from the hurricane caused an opening in the home, i.e. ripped off your roof, or broke a window causing water to come in the home; this would be covered under your homeowners policy.

- Why do you need it? The statistics are startling. Over 25% of claims are filed by homeowners who did not have flood coverage because they were not located in a flood zone. When summer rolls around, heavy afternoon storms are a norm in Florida. Flash flooding has become more of an issue in recent years as climate change continues to affect our weather patterns.

- When should I get flood insurance? Obtain flood insurance together with your homeowners policy. Florida Peninsula offers an endorsement for qualifying homes, which allow you to have all the coverage under one policy; eliminating the need to pay two bills, maintain two policies, or file two claims should the need arise.

Buying a home is exciting, and knowing what to look for can provide you with savings in your forever home.

A Florida Peninsula homeowners policy protects you from the elements with comprehensive coverage at competitive pricing. Ask your agent, how they can help you find the proper coverage or call us at 877-229-2244.